ESG Trailblazers: Developing Resilient, Sustainable Communities

By: Kinkini Chakraborty, Shubham Pal, Anurag Bajpai and Shweta Shukla

Climate change poses a variety of risks to real estate investments, ranging from heat waves that drive up energy costs to rising sea levels that sweep away coastal homes. But while real estate investors are typically aware of the physical threats posed by climate change, they may not be as aware of the difficulties associated with the low-carbon transition. Global carbon dioxide emissions are attributed to the real estate industry by around 40%. Building operations generate around 70% of these emissions, with construction accounting for the remaining 30%. The real estate industry must undergo substantial transformations in order to meet the demands of national and international climate targets, which call for drastic emissions reductions in both construction and operations.

The public, investors, and governments are becoming more dedicated to achieving net-zero emissions. Governments, investors, and the public have become increasingly committed to reaching net-zero emissions by 2050. This ambition intends to mitigate the worst potential effects of climate change by limiting warming to 1.5˚ C above pre-industrial levels. Policies to achieve net zero that impact the real estate sector include rising carbon prices, building and energy efficiency standards, and renewable energy mandates. High carbon prices can translate into higher energy costs and increased operating expenses for real assets. Property owners may need to make investments to meet new energy efficiency standards to avoid restrictions on renting or sales. These additional costs may make outmoded, high-emitting assets less desirable.

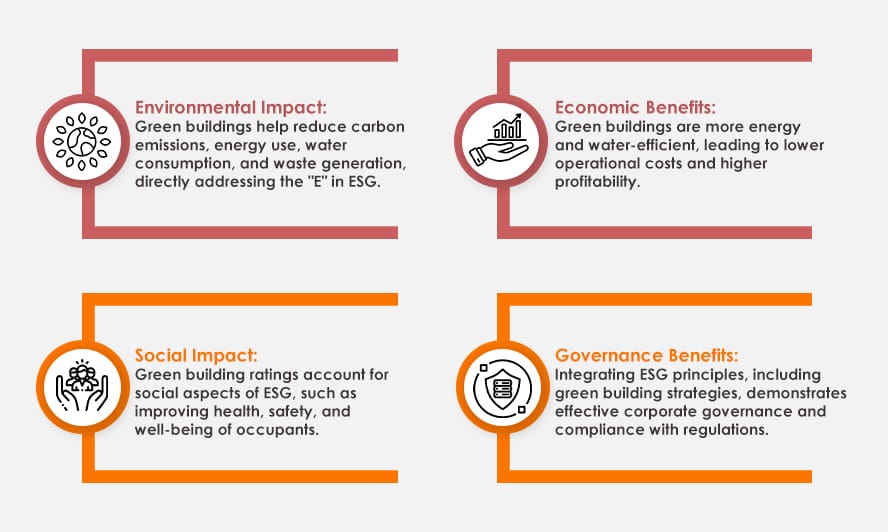

Buildings are an integral part of our daily lives as they provide spaces for workspace, living & recreation. However, to curb the environmental impacts of the building, many parameters have to be looked upon with due care like energy efficiency, water management, waste management, indoor air quality, etc.

The social dimension of ESG must adhere to the norms that enhance the well-being and quality of life of its occupants and the broader community. By focusing on health and well-being, accessibility, community integration, safety, and social impact, building owners and operators can contribute to the creation of more resilient, inclusive, and vibrant communities.

Governance is essential for maintaining transparency, accountability, and ethical standards in the real estate sector, influencing how buildings are developed, managed, and maintained.

With growing sustainability concerns among real estate developers, real estate businesses are shifting towards ESG as it will help them analyze the long-term viability & ethical practices of businesses including real estate.

Benefits of ESG in Real Estate

- Helps to Extend the Utility of Materials: Developers who use sustainable materials and emphasize recycling help increase the utility of materials, reducing the rate of harvesting new materials and environmental pressure

- Enhanced Market Competitiveness: ESG integration can lead to improved market positioning and attractiveness to potential investors, tenants, and partners

- Increased Funding and Lower Cost of Capital: Good ESG performance can significantly influence financing options, making properties with strong ESG credentials more attractive to investors and reducing the cost of capital

- Higher Profitability: Commercial properties with robust ESG ratings see direct financial benefits, including operational savings, increased productivity, and enhanced tenant retention, contributing to higher profitability

- Reduced Tail Risk: Real estate assets with comprehensive ESG strategies experience fewer instances of idiosyncratic risks, such as regulatory penalties or damages from poorly managed properties, preserving asset value and owner reputation

- Lower Systematic Risk: Properties with high ESG ratings often exhibit lower volatility and systematic risks, leading to more stable returns and enhanced asset value

- Improved Tenant Retention: Properties that adhere to ESG standards often command higher rents and boast better resale values due to their appeal to a growing demographic concerned with sustainability

- Enhanced Reputation: Companies that demonstrate a commitment to ESG principles and future plans that address climate risks are seen as forward-thinking, trustworthy, and socially responsible, making them more attractive to investors

- Increased Tenant Demand: By actively working to improve the local community, real estate companies can attract lucrative tenants and generate higher property values

- Better Compliance with Regulations: Strong corporate governance ensures compliance with regulations, building trust among stakeholders and investors

- Support for Community Initiatives: Initiatives such as community engagement, inclusivity, and affordable housing align with ESG principles, fostering goodwill and strengthening long-term relationships with stakeholders

- Energy Efficiency: Energy-efficient buildings reduce operational costs over time, making them more attractive to investors and tenants

How GreenTree Global can benefit you in the Real Estate Business?

We at GreenTree Global have 15 years of experience in the field of Carbon Efficiency, ESG & Climate Change. We have executed over 900+ projects around the world having expertise in carbon efficiency projects - from concept to commissioning & operation Headquartered in Delhi NCR & have offices in Mumbai, Dehradun, Guwahati, Lucknow & Bangladesh.

We are the official partner of (Global Real Estate Sustainability Benchmark) GRESB assisting clients with the ESG mandatory disclosures thereby improving their performance towards their sustainability goals.GreenTree Global further provides consultancy services to provide ESG certification.

How GreenTree Global will offer ESG Disclosure?

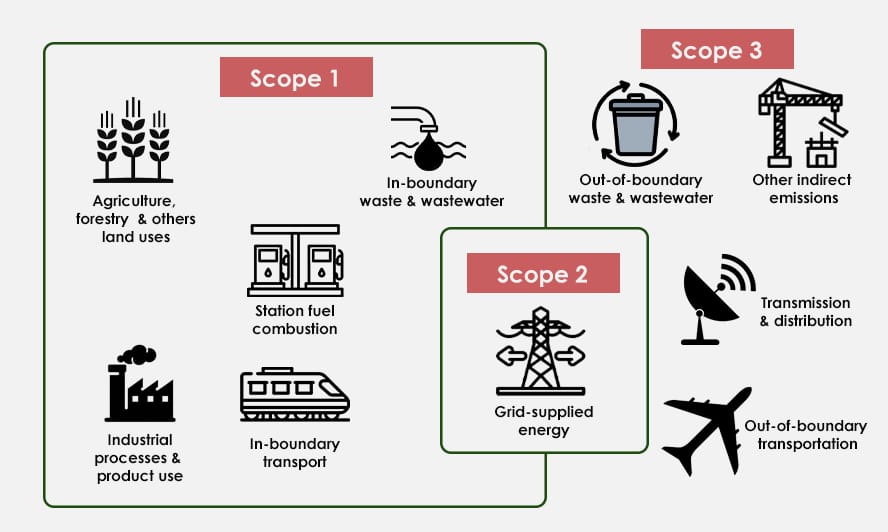

- Assessment: We begin with a thorough assessment of your current ESG practices, identifying gaps and opportunities for improvement. We will collect data & review all relevant ESG documentation, including sustainability reports, policies, procedures & previous assessments including scope emissions 1, 2 & 3 . Integrating scope emissions management into ESG strategies not only helps organizations mitigate environmental impacts but also strengthens their overall sustainability performance.

- Strategy Development: Collaboratively, we will organize internal workshops & external consultation to establish a clear ESG vision & strategy that aligns with your business objectives and industry standards. We will update the materiality assessment & mitigate the identified risks

- Policy Implementation: We assist in seamlessly integrating ESG practices into your operations, ensuring these become an integral part of your corporate culture. This involves translating strategy into actionable policies, embedding them into daily operations, and fostering a culture of sustainability.

- Measurement and Reporting: Establishing key performance indicators (KPIs), we regularly measure progress and provide transparent reporting to demonstrate your ESG commitment. We will implement robust data collection systems to gather accurate & timely ESG data.

- Continuous Improvement: ESG is a continuous journey. We offer ongoing support to review and enhance your ESG practices, keeping you ahead of the curve. We will organize periodic reviews, feedback collection & employment strategies to support your sustainability agenda. We will train employees & equip leaders with the knowledge and skills to effectively champion and drive ESG initiatives within the organization.

How does Green Building help in ESG reporting?

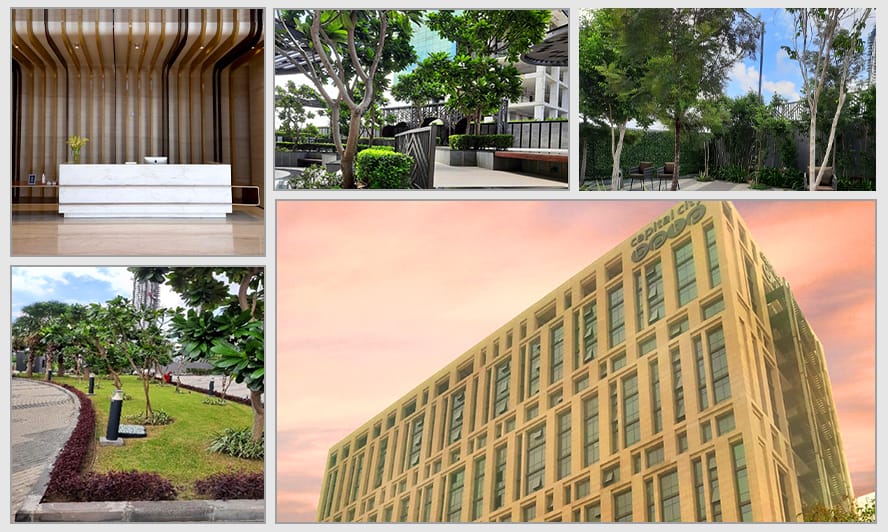

Ongoing Project: BPTP Capital City

These projects underwent ESG certification through the Global Real Estate Sustainability Benchmark (GRESB), a global benchmark for real assets. Together we have revolutionized real estate development, setting new benchmarks in environmental stewardship, social well-being, and governance excellence. Greentree Global’s technical assistance & consultancy played a pivotal role in achieving the highest rating from GRESB & fulfilling all certification requirements, thus proving our commitment to sustainability leadership.

Contact us:

+91 8076654783, +91 9811122522

[email protected], [email protected]