Introducing the First Green Building Newsletter of India

GreenLetter's objective is to create an information resource to help developers, researchers, designers, architects, engineers, officials, technology providers, and material manufacturers. The collective and filtered information may help all stakeholders in making them ahead with sustainability-related decisions.

Green Building Market Development Initiative

The impact of climate change, depletion of the ozone layer, pollution of air & water are quite visible now. The construction industry is the foremost reason for these environmental concerns. While 50% of the commercial building stock is yet to be built by 2030 [BEE, India], green building design is the key to sustainable development. The real estate industry has responded well by projecting sustainability as their projects’ USP. The main objectives are to preserve natural resources, optimise usage of energy & water, and improve air-quality & manage waste during buildings’ design, construction & operation.

This initiative by GreenTree will provide deep insights into green building market development. The data analysis shall include the registered & certified projects with location & building typology. Initially, we have covered information from IGBC, LEED & GRIHA, and have planned to cover more such as WELL, EDGE, GHAR, BEE Star Rating, & GEM, Suraksha Index in next issues.

1. The prominent green building rating systems

Leadership in Energy and Environmental Design (LEED)

- LEED is developed by USGBC in the year 1998.

- Projects acquire Certified, Silver, Gold, or Platinum level Certification. It covers all building types like BD+C, ID+C, O+M, ND, Homes, Cities & Communities, Recreation, & LEED Zero.

Indian Green Building Council (IGBC)

- IGBC is a part of the CII-Green Business Centre that started in 2001.

- It evaluates the performance as per Certified, Silver, Gold, or Platinum levels. IGBC has 25 rating systems matching the needs of every type and size of the buildings.

Green Rating for Integrated Habitat Assessment (GRIHA)

- GRIHA is developed by TERI and supported by MNRE in 2007.

- It evaluates building performance in five levels (1 star to 5 stars). GRIHA has 7 variants fulfilling to all types of buildings.

Other Rating systems in India

- WELL, EDGE, GEM, GHAR, BEE’s Star Rating are other available options. GreenLetter will describe them in the next release.

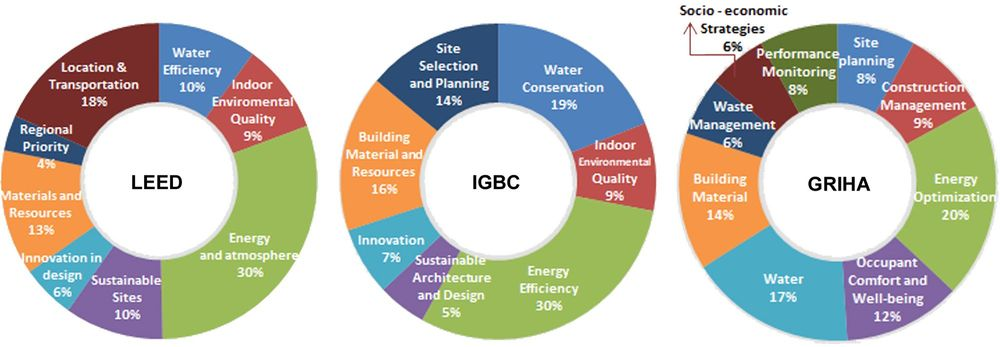

1.1 Weightage of green parameters in ratings

The rating systems have focused on the social, environmental and economic goals of buildings and allot the points to each strategy as per its ability to meet those goals, as under,

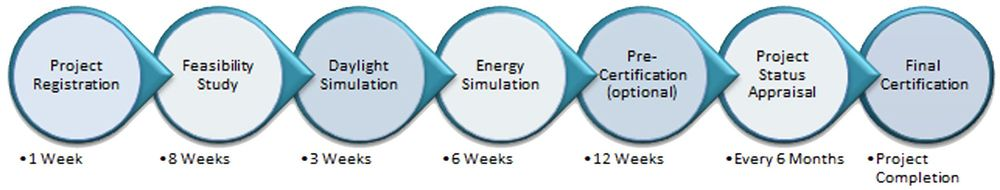

1.2 Green Building certification process

1.3 Policy framework-green movement in India

Energy Conservation Building Code (ECBC) sets minimum energy standards for non-residential buildings having a connected load of 100kW or contract demand of 120 KVA and above. Under the EC Act 2001, the state governments are empowered to modify the code to suit local needs. BEE launched ECBC in 2007 and updated it in 2017. Currently, 22 states have completed the amendment, 15 states have issued notifications and 11 states have updated their building bye-laws on state levels. Eco Niwas Samhita for residential buildings has been launched in 2018 by BEE and applies to all residential projects built on plot area ≥ 500 m2

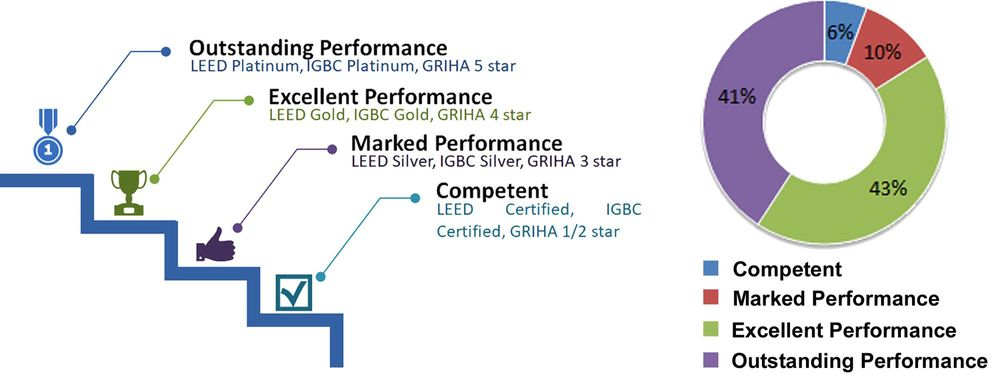

1.4 Defined performance levels

For integrative analysis, the levels in various rating systems are merged into common performance level, i.e. Outstanding, Excellent, Marked, Competent Performance as per the data received from IGBC, GBCI, and data collected by desk research. It is inferred that maximum rated buildings have achieved excellent performance; this means either they have targeted for outstanding performance level but settled to a lower level or minimum target to get excellent performance that is linked with ULBs incentives.

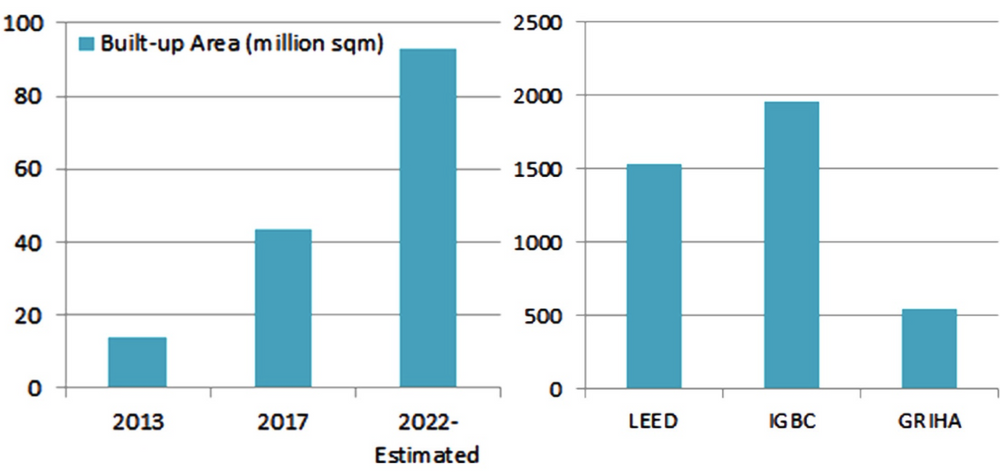

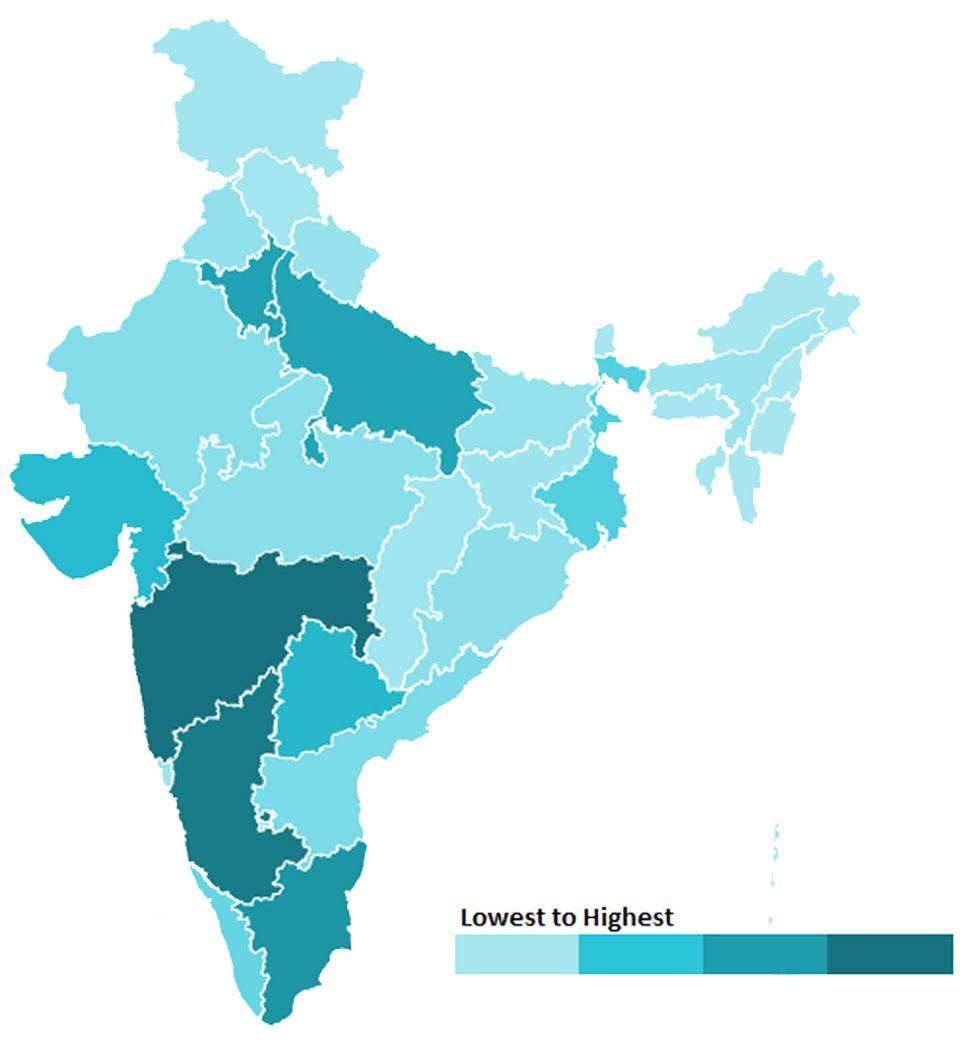

2. Green building market in India

India has demonstrated its commitment to eco-friendly, sustainable and green practices. However, at present, the current stock of green buildings in India is only 5% of the total buildings in India. Growing at an exponential rate, the Indian green buildings' market may reach around 93 million sq. m by 2022 [Go Green, Anarock, 2018].

Note: GBCI began managing the LEED projects in India on June 5, 2014, which were previously managed by IGBC. Hence, the data for certified green buildings (registered as LEED India) are overlapping between IGBC & LEED.

Buildings being state subject, the state government agencies started offering incentives for green building projects. To learn more about incentives, click below

Currently, in India, there are two methods used: the traditional governing command-and-control approach through local bye-laws, NBC, ECBC, and fiscal/FAR incentives; The latter is coupled with green certification which has helped the market grow towards green.

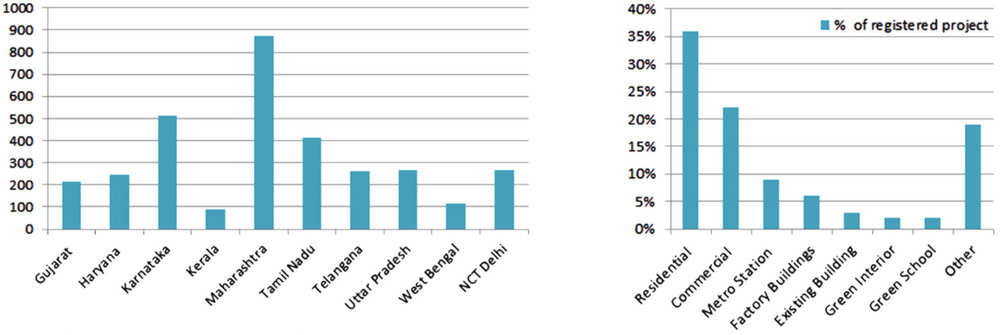

The studies illustrate the growth of the residential sector from the year 2010 to 2020 with almost close to 10%. IGBC launched the pilot version of IGBC GH (Green Homes) in 2008. Around the same time, some ULBs (Noida Development Authority & Pimpri-Chinchwad Municipal Corporation) started the incentive programs related to FAR and a property tax rebate for the upcoming projects following IGBC/GRIHA/LEED. For a long period, LEED & GRIHA could not address the residential sector’s needs and IGBC received the early mover advantage.

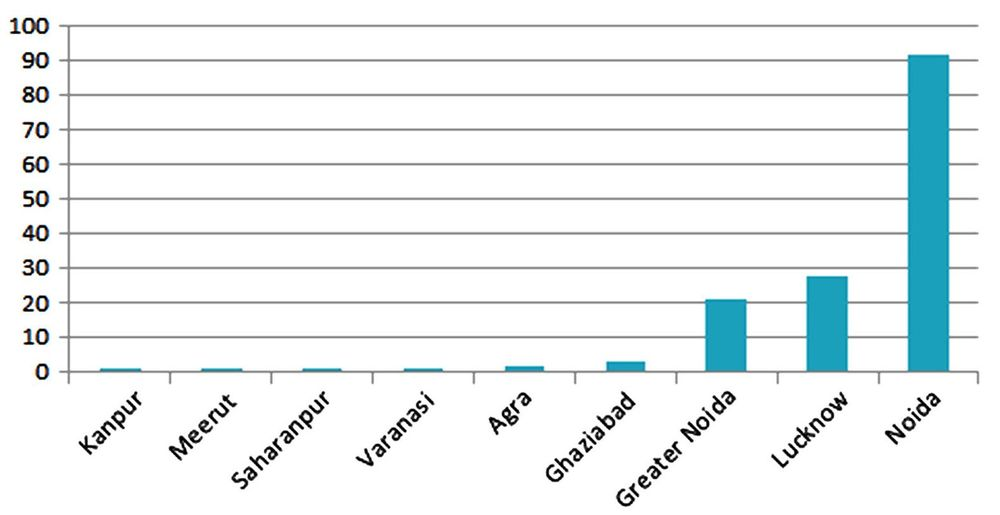

The team has taken up the most populous state, i.e. Uttar Pradesh to detail it further. Noida has maximum green building projects, followed by Lucknow and Greater Noida. Noida comes under the UPSIDC and, in 2010; the authority has decided to give incentives to the developers in the form of free FAR. Further, Noida is a part of NCR, it is developing at a faster pace with stakeholders having more awareness about green buildings. Lucknow comes under Awas Vikas, which started incentives scheme in 2015. The timely incentives became the boon for Noida and it has got the early mover advantage.

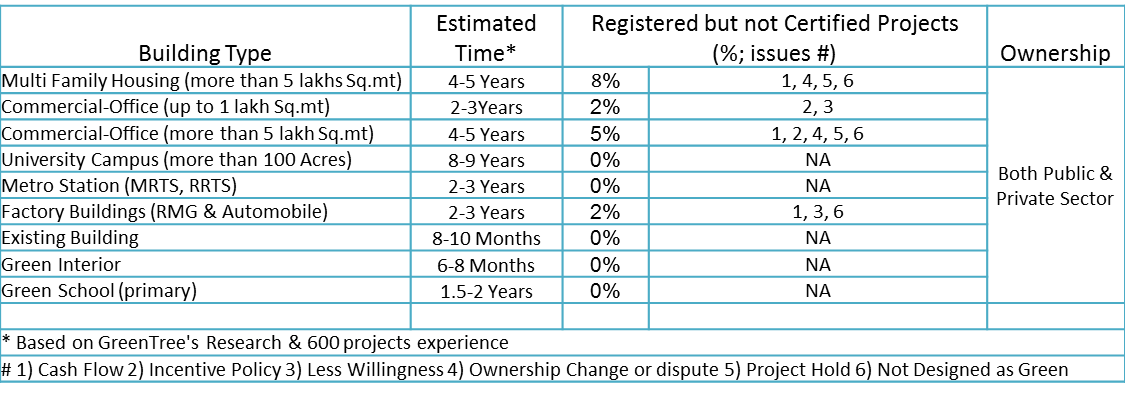

2.1 All registered buildings are not certified

2.2 Triggers to green building market

Indian construction industry anticipates steep growth in green buildings. It is driven by awareness level, tangible benefits and the requirement of breathable buildings post COVID19 situation. Below are the few key factors responsible for enhanced green buildings demand,

- Provision of incentives by states and municipalities is seen to be the strongest driver in the growth of green building market.

- Mandating the implementation of ECBC in various states is the need of the hour. Recently, BEE has also started exploring the incentive models for ECBC compliant buildings.

- New rating systems like GEM, GreenCo, GHAR, Suraksha Index will try to have bigger footprint.

- Ministry of Railways has inked a MoU with CII for greening of its establishments. Recently, Indian Railways has announced to be net-zero carbon emission mass transportation network.

- The corporate like Reliance has targeted to be Net Zero emission company.

- Actual building performance with respect to water and energy will be a good step to make the end user convince for the green adoption. The GBCI’s ARC and IGBC’s initiatives like Performance Challenge may play good starting points.

3. Building market opportunities

With expected V-shape or U-curve resurgent of economic growth post COVID19, India is poised to rebuild with more focus on industrial infrastructure along with healthy buildings. There will be a demand for architects, technicians, energy experts, environmentalists, consultants etc. having adequate domain knowledge. Although all rating agencies like USGBC, IGBC, GRIHA, BEE and GEM have already amassed certified or accredited professionals as a green building resource. But the opportunities in green buildings market are visible; hence, all the agencies are also working at college level to catch the professionals young and to make them industry ready. With the intent of bringing the opportunities closer to professionals or organisations, our team shall also provide the live tenders linked with google drive. We hope this effort will be consolidated over a period of time.

3.1 Expert Team comments

Government policies such as PMAY act as a catalyst to boost growth in affordable housing. We feel that state specific regulations – UDD bye-laws, RERA Act must embrace green features like high performance envelope and common area equipments so that operational cost can also be made affordable along with comfort conditions for the end users. If we keep practicing the matchbox stacks with RCC wall, then envelope will get integrated with millions of window ACs or condenser units in few years. The launch of affordable housing ratings from IGBC & GRIHA has supported the development but the adoption percentage is yet to cross the double digit. Concerning the post COVID19 scenario, we foresee more immediate opportunities in Green Warehousing, Data Centres, and Existing Buildings, etc.

4. What's next?

- Policy initiatives

- The updated numbers of registered and certified green projects in India along with inferences.

- Market opportunities for all- students, professionals, organisations, manufacturer.

- Our team is also working to bring the innovative technologies and green materials to our readers. We would like to dedicate one section for the upcoming technologies in this domain.

Note: The team has sourced the data through the rating agencies and desk research. Collaboration with other rating agencies are in progress to make the information comprehensive. For any query, please contact: [email protected]

GreenLetter (GNAUG20) Team: Nidhi Khosla, Pradeep Kumar, Dhruv Jain, Anurag Bajpai