The Landscape for Electric Vehicles & Charging Infrastructure in India: A Case Study

Electric Vehicles have been around in India for quite some years now. The first passenger EV called Reva was launched in 2001. It’s been over 18 years since the first launch, however, the speed of adoption of EVs has been very tepid with only ~10,000 e-4w being sold in India so far (till 31st March 2019) as per SMEV Data. The EV market in India, the country with 4th largest auto market in the world, has thus failed to evoke any significant interest of automakers in all these years with minimal investments by the Auto OEMs into EV technology.

With the introduction of FAME-1 in 2015 followed by FAME-2 in 2019, the market has started to look up slightly and investments have started trickling in. For example, the growth in volume of e-4w from 2018 to 2019 has been 300%. Thus, to study the future development trajectory of this market, we recently concluded a study for one of our clients (an OEM supplying charging infrastructure).

The objective of the study was to map the entire value chain and estimate the market size of EVs & EV charging infrastructure for the period 2019-2030. During the course of our research, we interacted with various stakeholders in the urban transportation sector like individual vehicle owners, OEMs, shared mobility service providers, Power utility companies to understand their plans on EV adoption and the investments planned therein.

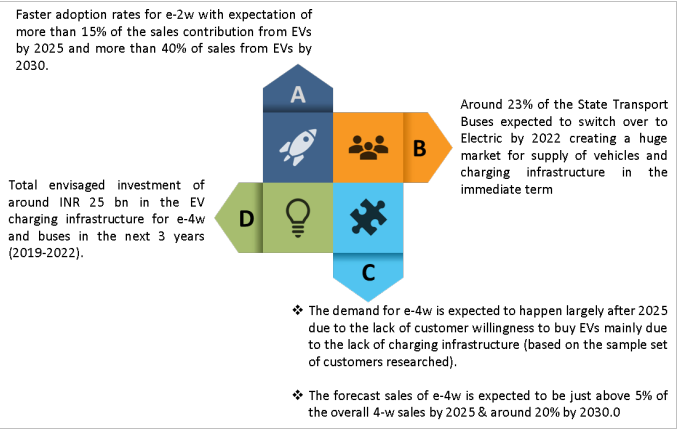

The research also looked at the existing data points with regards to the sales of EVs, types of charging stations, business models, policies and regulations, and investments made and planned by auto OEMsin this space. Keyfindings on the market situation are listed below:

A typical schematic of the charging infrastructure is given below. The charging infrastructure shall comprise of mainly three elements:

- Compact Sub Station (for Grid Connectivity)

- The Charging Poles (AC or DC)

- Operation Control centre (for monitoring utilization, bill generation, checking remote availability for multiple charging stations, etc.)

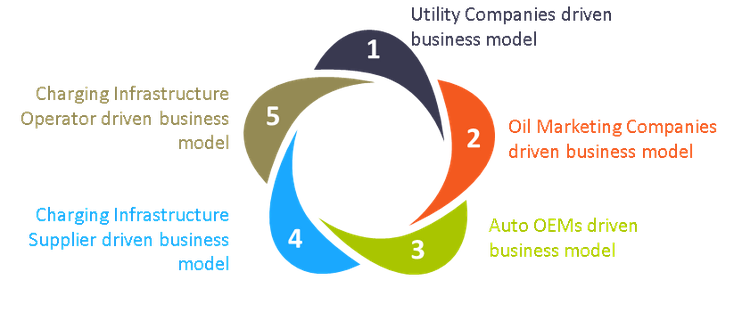

As a part of the study, we also conducted an assessment to evaluate the attractiveness of business models for India. For this, we conducted a broad research on the various business models for EV Charging Infrastructure prevalent in countries with high EV uptake. We then superimposed these models on the Indian market and ranked them based on their success likelihood using several criteria. The business models have been listed below in the order of success potential with the first one having the highest success probability based on our assessment & the last one having the least success probability.

Some of the key parameters that are expected to determine the probability of success of these business models are as follows:

Based on our research, it has been thus been concluded that in the near future, independent Utility companies are poised for a greater chance of success in this market.

The reasons for this higher probability are derived from the underlying factors driving their business models e.g., access to low cost capital, existing distribution network, current technical capabilities in the value chain and better economic efficiency due to integration in the supply chain. We are keeping a close watch on the market so see how it unfolds in the months to come!

For more detailed insights on the study, please feel free to contact us at [email protected]